It’s fair to say that the insurance industry has never been an early adopter when it comes to tech innovation.

However, the conservative and traditionally product-centric insurance market is steadily becoming technologically advanced, even though this transformation takes time. Insurance companies, as well as banks and other financial providers, are facing new challenges and are forced to respond to digital disruption by providing a new kind of customer experience.

As customers prefer digitalized communication, clarity, and transparency, this is the right time to be a part of the trend. Gone are the days with 30-page application forms that clients fail to understand. Previously, consumers could hear from insurers once a year about the renewal of their policy not even understanding the coverage provided. Now, with a customer-oriented business focus, they are aware of every change that is going on.

Of course, no transformation is easy.

Insurance leaders are having a tough time responding to this new set of needs. Nearly 40% of them feel uncomfortable and are extremely concerned about the pace of shifting to the new approach. In addition, AI, ML, IoT, Blockchain, and other emerging technologies are enabling InsurTech startups to enter the market. While insurers still have an advantage in knowledge and expertise, they can’t sit still and walk a fine line in order not to lose their bread-and-butter businesses.

Insurance challenges 2020

People don’t look for insurance, they want to protect themselves and the stuff they care about. Insurance companies constantly face regulatory changes, macro-economic uncertainties, innovations, decreasing loyalty, and commoditization.

That said, in 2020 they will have to deal with the digitalization of business processes. This leads to the following challenges:

Grow business via customer experience.

Many insurance carriers fail to meet policyholders’ expectations. 84% of customers are looking for immediate accuracy and responsiveness that they receive in other markets. 40% of them continue insurer relationships based on the quality of experience. Attracting new customers and keeping existing ones is crucial so easy-to-use friendly solutions should be at the top.

Maintain legacy systems.

Many companies, especially established ones, trust their business to complex disconnected legacy systems that require major financial and human resources. Another problem lies in finding the right talent: 65% of insurance organizations find the process long and expensive.

Information and workflow management.

Insurance carriers struggle to handle manual process steps including repetitive tasks, creating reports, managing claims, and requests. Finding and processing the required data becomes harder, longer and less efficient;

Staff lack.

In the US only, just 2% of university alumni plan to work in insurance. It means that many insurance companies lack the skilled staff required to follow, apply and develop new insurance innovations;

Fraudulent claims cost.

Fraud costs the insurance industry $30 billion annually, pushing insurers to seek smarter, effective, and more secure solutions. Today, fraud analysis is mostly done after-the-fact and includes rather conventional management approaches. In other words, nobody is trying to invest in fraud prevention.

Cyber risks management.

As technology evolves, understanding cyber threats will help companies meet their customers’ associated needs. Things like covering the value of losses from data breaches, loss of reputation, settlement costs, and cyber extortion.

Rise of digitalization.

With tech giants already entering the market, insurers need to take care of web and mobile-first platforms and brands. As 68% of consumers buy auto insurance on the web, an online presence is a must in this niche. It means delivering solutions via web/mobile, call centers, and chatbots anywhere and anytime. In line with the global regulations, of course.

In 2020 the balance of power is shifting from product to consumer.

Social trends are going to disrupt traditional business patterns and strategies in the insurance industry, mainly due to technological innovation. Although the insurance sector has a bad reputation for falling behind with tech advancements, it is important to stay up to date for your company’s growth and your customers’ satisfaction.

Not every technology needs to be used, but being knowledgeable of the trends will help you be on the same page with your customers. And when you share their concerns, you can offer relevant solutions.

Insurers and InsurTech

With companies like Amazon, Google, and Apple providing their customers with rich digital experience, users are demanding the same individual approach from insurance companies.

Now more than ever they feel the presence of newer startups that meet customers’ expectations in the shortest terms – the InsurTech. New technology-led players are entering the insurance sector to provide coverage to a more digitally savvy customer base. They create a competitive threat and potentially valuable opportunities for partnering on the changing terrain.

In response, insurers must embrace change and rethink their business approach to move forwards to an agile, digitally-enabled, customer-centered experience and achieve competitive advantages by meeting tomorrow’s customer needs.

Although insurtechs have not yet paved their way in the field, they are growing fast enough to capture a good share of value pools within a few years. The size of insurance companies’ share depends on how quickly they can adapt to the new market rules and become scalable.

Now, there are two primary types of insurtech, with a number of others rapidly catching upon:

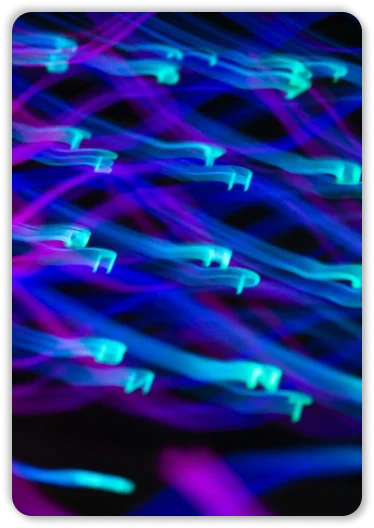

Insuretech type 1: Blockchain

Insurance firms have started to slowly but surely integrate Blockchain in their processes over the last few years, and 2020 expects to see this flow sped up a few times. Blockchain enables creating a digital ledger that cannot be changed, becoming a giant audit trail of all transactions. With its help insurers can reduce admin costs that come from numerous claims and billing usually made by third parties.

Blockchain technology ensures sharing, protecting, and verifying all data via smart contracts, saving insurance companies around $5-10Bn yearly by excluding a lot of unnecessary actions. The main value here is to avoid fraud and make customers’ claims resolved much faster.

Try to think of insurance as a smart contract which is exactly what it is: people pay money to be covered on the terms specified in a contract.

Breaking down blockchain for fintech

To understand better how it all works, let’s imagine you’ve decided to buy a house from a retailer:

- A customer adds all house information to Blockchain to create a smart contract and indicates their preference with the insurance company X. Prior to closing, a smart contract integrates all the data about the house (number of floors/rooms, location, quality of construction, etc.) with the insurance company X;

- Insurance company X uses these details to underwrite the policy, generate a binder, and a payment request, which adds as a block to the customer’s chain. The invoice request then adds to the closing costs and then paid from the closing proceedings;

- A customer creates a block that has the following information: the date, dollar amount, and other details of the transaction. Using all this data, the system generates a complex encrypted hash function with a unique digital signature. This block adds to the public chain interlinked with previous blocks of this chain;

- A hacker wants to change the past data. To do this, he/she has to change not only this block but all the previous and following blocks at the same time and stay undetected by the network, which is nearly impossible;

- Both the retailer and customer are protected with a smart contract of the insurance company X which is activated based on a set of conditions or business agreements. If any claim appears in the Blockchain network and the terms are met, a decision is made instantly. It happens because X uses Blockchain to automate large parts of their manual processes keeping their customers and wallets satisfied.

Usage statistic

According to statistics, 44% of insurers have no idea how Blockchain can be useful. 21% are thinking about implementing it to simplify the claim process and reduce fraud. Only 2% actually apply technology.

Using Blockchain in insurance can cause a fundamental shift in all processes. Although its future still depends on legal hurdles and public acceptance, it is too powerful to ignore.

Insuretech type 2: Artificial Intelligence

Insurers believe that AI will significantly transform the industry in the next three years. Functions like fraud prevention, price and risk identification, and policy and claims processing are based on removing the human factor. It allows to access data faster, predict risks, produce more accurate reporting in tight timeframes, improve turnaround cycles, identify new revenue sources, and change the underwriting process fundamentally.

In the insurance world, machines that can learn independently are becoming game-changers in several important areas:

Autonomous vehicles.

Autonomous (driverless) vehicles are no longer the future as they slowly integrate into society, changing the face of auto insurance. These days, in case of a car accident the fault lies fully on either of the human drivers, but with fewer people involved who will be guilty then? Google, Mercedes, Tesla, and Volvo already stated they would accept liability for any accidents with their cars while Uber created a need for ridesharing insurance instead of typical auto coverage. It makes insurance agents reconsider their current policies to bridge the gap between them and technologies;

Personalization.

In 2020 personalization and customer-centered approach will prevail which means that insurance companies need to supply personalized premiums. That requires diving deep into data: 77% of customers are ready to provide it if they can benefit from a cheaper premium package. For example, smart home technology that allows people to monitor their electricity and water usage and check the cameras while they are away is the case to provide a personalized premium as there is less chance of theft. Another case is wearables that are used for health insurance personalization: if a person takes 10K steps a day it may be a reason for a cheaper premium as the risk is lower;

Enhanced customer experience.

AI will keep improving customer experience across all sectors in insurance:

- In claims settlement, there is no place for manual work: in addition to processes automatization for employees, AI allows customers to manage their claims via self-service. For example, in case of a flight cancellation that becomes a reason for a high volume of claims, customers can log in to the AI-powered platform to check the details of cancellation and be instantly paid on the claim. Only if the request fails, it involves a human’s review;

- Chatbots. As insurance is usually pretty complicated for customers to understand, it leads to a great number of clarification requests. This problem can be solved by trained conversational AI bots handling customers queries: by 2025, 95% of customer interactions will be powered by them. The ability to work 24/7 significantly cuts the costs compared to human employees and immediate reaction improves customers’ experience. Some companies even think of chatbot agents integrated into the process;

- All-in-one. Traditionally customers have different insurance providers for travel, auto, residential, life, health, pet, and legal insurance. By data analysis, companies can gather all customer information in a single profile and provide a single package for all insurance types.

This is just a short list of basic AI values for insurance companies.

Additional values

We can also add the use of telematics in car insurance to collect real-time driving data. It encourages safe-driving drivers and penalizes those that are speeding. Natural language processing can extract necessary data from unstructured piles of documents, emails, chats, and other sources of our day-to-day interaction, reducing the time for processing the claim.

At the same time, the computer vision used by 20% of insurers already allows us to extract meaning from visual data.

For example, users take pictures of the damaged vehicle. Then, an AI Auto Damage Estimator (trained on thousands of car accident photos) can assess the damage and costs of the claim within seconds. All this is supported by real-time analytics, fraud prevention, and smart suggestions to deliver better service and increase incomes.

Thinking ahead

Although AI-based insurance is still in its early stages, insurers have to already start thinking about its implementation in their current processes in order to stay ahead.

These technologies are just the tip of the iceberg with more coming soon. The internal processes across the industry are overly complicated right now. Over 1 million jobs in the US alone can be automated, saving costs by up to 40%.

Of course, transitioning from paper to online is not easy. 9 out of 10 insurance companies say they are struggling to develop the technology infrastructure they need, blaming legacy software and outdated IT systems. However, digitalization is not always enough as it requires the complete transformation of existing business models.

To overcome these problems and enable new efficient offerings, insurance companies are developing modern solutions using offshore talents. To boost data-harvesting capabilities, internal workflow automation, and keep the right balance, they focus on building customized software solutions. These can be claimed processing functionalities, claim and policy management platforms, peer-to-peer insurance, APIs, personalized pricing, chatbots, fraud detection software, and even insurance marketplaces.

Getting the most from insurtech

Insurtech has shaken up the insurance business with new solutions and better experiences. One of the biggest challenges for the traditional insurers is to combine their years of experience (something insurtech companies lack) with new ways of interaction between customers, agents, and partners. That said, almost 90% of insurance executives state that they have a clear long-term plan for technology innovation.

Of course, this is not done overnight, but some of the companies have already started the process:

- In 2019, almost 80% of insurance companies’ CEOs agreed that AI should soon become a part of their business model;

- Increased use of IoT sensors, AI, ML, and Blockchain combination has already helped businesses move forward towards proactive operations;

- Over 30% of insurers already use these technologies in their business.

Tranformation limitations

However, the integration of innovative technologies and reconsideration of current business models isn’t the logical next step for everyone yet.

Understanding the essence of the customer-centric approach has been a struggle for many insurers. They have to get the necessity of breaking their legacy shells to grow with the changing times. What does it mean?

- What used to be a sign of success may be not so anymore. Large companies no longer mean trust and stability;

- Speed matters more than ever. Customers require next day delivery and claim decisions in less than a minute;

- Being agile is a must. Successful digital transformation means implementing agile ways of working not only in IT departments but beyond.

Yes, data is the king: being able to collect, clean, store, transmit, protect, predict, and analyze data is essential. Making use of this data, there are priorities to set off from:

Understand your customers.

Discovering the customers’ needs is still the heart of any successful innovation. Speak the language of Millenials to have a relevant approach based on their behavior;

Make a SWOT.

In addition to understanding your customers, you need to have an idea about your strengths, weaknesses, opportunities, and threats. It is crucial to stand out and offer your customer a different service in terms of innovation and customer experience;

Explore your business model.

Say hello to insurance as the industry with multiple business models. The ability to build supply and demand chains, revenue models, and control points is as crucial as underwriting today. However, there is a difference between the model on paper and the MVP with initial customers to target;

Create a connected digital ecosystem.

A variety of insurance companies expand their businesses and broaden markets by accepting other companies in their ecosystem – the so-called big to small collaboration. Both startups and insurers have strengths and both are hungry so why not work together for a mutual interest based on agility?

Build the right platforms.

To ensure that your business can support tech change, you require the right digital architecture and cloud infrastructure. Today many insurers have a pile of complex outdated IT systems, so the idea of changing it seems risky and expensive.

However, this is the first step to build a technology foundation ready for the future. As many traditional IT departments struggle at this stage, insurers often find help in hiring an offshore development team.

These are some very good waves for change-makers to ride in the market and future-proof the insurance venture. Customer expectations for real-time communication, individual approach, convenience, and transparency are re-shaping the industry. So, wherever you choose to place your bets, don’t expect a change and new status to emerge right away.

Keep in mind that:

- Great products are still essential. To build one you need a deep understanding of who your customers are and what they care about;

- Servicing claims still matter – you just have to use real-time data to keep the consistency;

- Underwriting is still crucial – you just need more complex data to fuel it.

Final word

Digital transformation is the journey from existing legacy systems to a customer-centric approach and one of the biggest challenges on the way is to trust technology and integrate it into daily operations. The fear of job loss still exists while the goal is not to replace a human but to make them focused on high-value tasks allowing customers more direct access to the information and self-service.

Insurance companies still have many hurdles to overcome as they look to remodel their businesses and retain market leadership status. That is why they need to have a coherent strategy, understand the cultural fit, and manage innovation.