Spike of popularity among contactless payment during Coronavirus pandemic

Coronavirus poses a huge threat to the economies and populations of all countries in the world. One of the sources of the virus’s spread is cash, which carries a huge amount of bacteria. ATMs with cash-recycling functions become a channel of disease transmission. A way out of it is making contactless payments, which allow you to pay instantly and avoid endangering yourself.

Even the World Health Organization recommends ditching cash in favor of contactless payments to prevent the spread of COVID-19. WHO issued this recommendation after China and Korea began separating and disinfecting used banknotes known to carry viruses and bacteria.

A representative of the World Health Organization noted in a recent interview with The Telegraph:

“We know that money often passes from hand to hand and can collect all kinds of bacteria and viruses. We advise people to wash their hands after handling banknotes and try not to touch their face. Wherever possible, it is advisable to use contactless payments to reduce the risk of the infection spreading.”

When will the economy recover?

Opinions vary greatly on how slow the global economy will grow.

The conclusion of the American Institute of International Finance looks quite pessimistic. IIF estimates the global economy to grow by a maximum of 1% in 2020 – the lowest since the 2007-2008 crisis. In China – the source of the virus – GDP growth will slow to 4% instead of the previously expected 5.9%.

Consulting company McKinsey&Company has outlined three scenarios of crisis development.

The softest scenario is the elimination of coronavirus outbreaks up to the second quarter of 2020. In this case, the global GDP will grow by about 2% instead of 2.5%. If the pandemic persists beyond the first half of the year, global economic growth will not exceed 1.5%. In case the pandemic continues to the second or third quarter, global GDP could fall by 1.5%.

So, how can you help the world? One of the options is by using contactless payments. A safe way of using money, its popularity is increasing tenfold due to the COVID-19 pandemic.

How does the technology work?

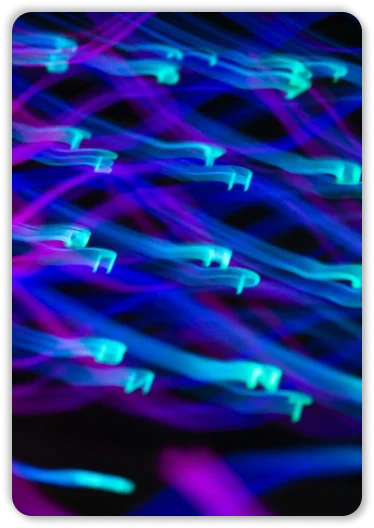

In most cases, contactless payments are enabled by NFC chips that are found in most modern smartphones and tablets, as well as in many smartwatches and smart bracelets. These chips can transfer encrypted data from a customer’s bank card to another chip, for example, in a POS terminal at a store. The data exchange takes 1-2 seconds, followed by a successful payment.

The contactless connection between the devices is conducted via radio signal (Radio Frequency Identification technology). NFC-chip uses a special radio frequency (13.56 MHz), which works only if the devices are close to each other.

There are two main options for using NFC technology in retail payments:

- The first way is payments by banking cards supporting contactless technologies (for example, MasterCard PayPass/ Visa PayWave).

- The second way, which is gaining popularity, is by mobile devices through paying services (Apple Pay, Android Pay, Samsung Pay).

Smart payments

To use a smartphone as a contactless payment tool, you need to tie a banking card to your smartphone using a special application. At this stage, the app generates and stores an encrypted “key” (token). After that, you can pay with your smartphone without using the card.

Contactless payment is becoming more and more entrenched in mobile devices. Near Field Communication (NFC) technology is already available in Apple, Samsung, and other mobile devices. In addition to NFC, Samsung has introduced magnetic security transfer (MST) technology for smartphones to interact with terminals that accept magnetic stripe cards.

Wearable devices also influence contactless payments. Some of the leading tech companies like Apple and Samsung produce watches with an embedded NFC chip. Traditional watchmakers, like Mondaine and Swatch, are also keeping up.

Now NFC technology is not only extremely convenient.

Contactless payments offer settlements security provided by the global digital tokenization platform Mastercard Digital Enablement Service (MDES). MDES allows turning any device with an NFC chip and an Internet connection into a secure payment tool, through creating a unique token to protect transactions. A token is a 16-digit combination tied to a user’s bank card number, which is unique for each connected device.

Tokenized payments hide bank card details. To verify the payer by the bank during the payment process Mastercard transforms the token into the card number.

Benefits of Contactless Payments

The main advantages of using contactless payments:

- Protection from COVID-19. Using contactless payments you avoid contact with things (money) that potentially can be infected with the coronavirus.

- Simplicity. One-touch purchase payment without pin code and signature. You need less time to pay for the purchase.

- Quick. Payment using contactless technology occurs almost instantly. This saves time for the client and makes the work of the cashier more effective.

- It’s an innovation. The most modern payment technology. If a business uses contactless payment – it gains respect from customers.

But how contactless payments affect business and economy? What are the examples of successful implementation of contactless payment technology?

Here’s a map of the contactless payment limits in various parts of the world:

Amazon initiatives

In 2016, eCommerce giant Amazon launched a new type of Amazon Go offline store in Seattle – with no cash registers or cashiers. In there, buyers just pick up the products and leave the store, and payments are done automatically, contactless, and discreetly.

The company combines RFID (radio frequency identification technology) with smart video cameras. The system records when a customer takes an item off the shelf, while video cameras locate the customer inside the store. Combined data analysis allows the system to identify who took which items and record it in a shopping list in the Amazon mobile app.

This approach allows customers to perform a reverse operation, return a product to the shelf and thus automatically exclude it from the virtual shopping basket. Products can be carried out in pockets or hands. Once a person goes through the turnstiles, the money is automatically deducted from his Amazon account.

Amazon Go, where the whole process of shopping (from selection to payment) is carried out by the buyer, brings 50% more profit than traditional stores.

Palm payments

The company is developing a new payment method that will allow consumers to pay for their purchases using the palm of their hand, without using a bank card.

Amazon had filed a patent for a “contactless biometric identification system” with a palm scanner. The tech giant is developing this project together with Visa and Mastercard. Major banking institutions, like JPMorgan and Wells Fargo, are also taking part in its development.

The company plans to offer customers an opportunity to tie the data of a bank card to their palms. This would allow them to make a purchase with one touch, without using “plastic”. Also, the company plans to introduce such payment in the supermarket chain “Whole Foods”. Clearly, Amazon is the leading contactless payment developing company in the world.

On-demand Economy

Contactless payments are becoming part of the “on-demand economy”. Taxi applications such as Uber, Bolt, Gett can be used for reference. These services allow users to tie a card to a mobile application once and then automatically pay for their trips without touching neither cash nor the interface of the application itself.

Besides mobile platforms, functions of contactless payments are available both on social networks (Facebook, Twitter) and messengers like Telegram, WhatsApp, and Viber.

Over the next decade, we will see more changes in the banking industry than in the last 100 years. KPMG Global’s research “The Future of Digital Banking” confirms that technologies such as Artificial Intelligence, Blockchain, Biometrics, 5G, AR/VR will have the greatest impact on the financial services industry in the next 10-15 years. So, voice command and biometrics can replace contactless payments pretty soon. Thanks to the “Internet of Things”, any device can become a digital channel for paying for goods and services.

Examples of successful implementation of contactless payments into banking systems are Monobank, Revolut, N26. All these banks are mobile, they have no offices, but are incredibly popular. Of course, among youth mostly.

These banks are actively competing with each other.

For example, N26 is one of the most highly regarded startups in the world. Revolut has attracted more than $350 million in investments for its development, valued at over $2 billion. Monobank reached the mark of 2 million users in just 3 years – an impressive result.

Effect on business and economy

The sphere of contactless payments is huge and is backed by eCommerce companies, blockchain platforms, mobile developers, financial projects, banks, and even companies specializing in passenger transportation.

The rapid development of mobile technologies and contactless payments is creating a new model of user behavior. This behavior model prefers the active use of smartphones, contactless payments and various connected devices in everyday life.

Banks that do not think about the development of contactless payments may lose both clients and time in the future.

One of the main factors that stimulate the development of contactless payments in the world is the desire to lead innovation. Contactless technologies are a sign of the modernity of banks and businesses.

The future of contactless payments

Many countries have already adopted cashless technology. Some experts even compare the number of NFC payments a country has to its economic potential. Although cash payments are still prevalent in developing countries, high-population states like China, India, Brazil, and the USA are already entering a contactless future.

According to Business Insider, the flagship for developing countries is China with its unique payment technology integrated into a local social network – WeChat. This subsidiary of China’s giant Tencent is a mix of services, one of which is WeChat Pay, a contactless payment system for more than 1 billion users. It allows sending money directly from one smartphone to another within the app, furtherly boosting the commercial boom in China.

According to the Merchant Savvy web service too, China dominates in contactless payment development. In February 2019, 1 out of 9 people on the planet used Chinese payment systems to send and receive cash during the Chinese New Year.

According to Worldpay’s 2018 Global Payment Report, mobile payments will continue to grow and become the second most popular method of payment after bank cards in the world by 2022.

In the US and Europe, card payments are still more popular than mobile payments. There are various reasons for this, but among the main ones are conservatism, as well as firmness of the authority of EMV chip cards, which are very popular among middle-class people.

Conclusion

Contactless payments are the future of money transfers. The coronavirus outbreak and its worldwide spread significantly increase the popularity of contactless payments because cash is transmitting COVID-19. Contactless payments are the best way to prevent the spreading of COVID-19.

Contactless payments are a very convenient way to transfer money. The business actively implements new technologies in its own work and increases NFC popularity. The cases described in this article demonstrate the potential for spreading contactless payments in the world.